What Is Ethical Investing?

Ethical investing, also known as socially responsible investing (SRI) or sustainable investing, has rapidly gained popularity as more investors seek to align their financial goals with their personal values. At its core, ethical investing means choosing investments based on personal values, often tied to environmental, social, or governance (ESG) factors.

Ethical investors avoid companies that engage in activities they consider harmful, like tobacco, fossil fuels, or weapons manufacturing. However, ethical investing isn’t just about avoiding harmful industries – it’s also about actively supporting companies and sectors that contribute positively to society and the environment.

What qualifies as “ethical” can be subjective. For some, it’s about environmental sustainability, while others may prioritise social justice or corporate governance. This makes ethical investing highly personalised and flexible based on individual values.

Methods of Ethical Investing

There are several strategies to build an ethical portfolio. Here are the three most common:

-

Negative Screening

This strategy involves excluding companies or sectors that don’t align with your values. Investors often avoid industries like gambling, alcohol, fossil fuels, or weapons. This method ensures your money is not supporting causes you oppose.

-

Positive Screening

In contrast to negative screening, positive screening means actively seeking out companies that are leaders in social or environmental responsibility. These could be firms involved in renewable energy, sustainable agriculture, or those with strong labour practices.

-

Impact Investing

Impact investing goes a step further, by prioritising measurable social or environmental impact alongside financial returns. Investors in this category often focus on companies addressing significant global challenges, such as climate change, healthcare access, or clean water initiatives.

The Pros of Ethical Investing

Ethical investing offers more than just peace of mind. Here are some advantages:

-

Aligns Values with Financial Goals

Ethical investing allows you to support causes you care about while working toward your financial objectives. For example, if you’re passionate about renewable energy, you can invest in clean energy companies without compromising your portfolio’s growth potential.

-

Potential for Competitive Returns

Contrary to the myth that ethical investments always underperform, many ethical funds have outpaced traditional investments. Companies with sustainable practices may be better positioned for long-term growth due to their lower risk of regulatory fines or environmental damage.

The Cons of Ethical Investing

While ethical investing has its perks, it’s essential to be aware of potential downsides:

-

Higher Fees

Ethical investment funds often have higher management fees due to the screening processes involved. It’s crucial to monitor these fees, as they can erode your returns over time. Some ethical funds charge as much as 2-2.5% in fees, which could impact your overall portfolio performance.

-

Limited Investment Options

Restricting your portfolio to only ethical investments may narrow your options. If your definition of ethical is too strict, it can reduce diversification, which is key to managing investment risk.

-

Greenwashing Risks

Greenwashing, where companies falsely claim to be environmentally responsible, is a growing concern. To avoid falling victim to greenwashing, always check third-party audits, company sustainability reports, and ESG ratings from trusted sources.

Financial Performance of Ethical Investments

Ethical investments can perform just as well, or potentially even better, than traditional investments. A 2020 report by the Responsible Investment Association Australasia (RIAA) showed that ethical funds in Australia often outperform non-ethical funds over the long term. However, if you have strict criteria on what you consider ethical, this may narrow your available investment options across various industries and sectors, which may make your portfolio less diversified and more vulnerable to market volatility. Our financial advisors can help ensure you strike the right balance between investments that align with your values and financial goals, with a diversified investment strategy.

Finding Ethical Investments

Several tools and resources can help you find ethical investments. Platforms like the RIAA provide a list of certified ethical investment options, ensuring that the companies meet strict ESG criteria. Additionally, ESG screening tools like Morningstar’s ESG Screener or MSCI ESG ratings can help you evaluate which companies or funds align with your values.

Aside from stocks, ethical investing opportunities extend to bonds (e.g. green bonds) and microfinance, allowing you to support smaller businesses or sustainable infrastructure projects. Our expert financial advisors can help you access these opportunities, and provide you with ethical investment advice and strategies that match your personal financial goals and values.

Trends in Ethical Investing

Thematic investing is becoming increasingly popular among ethical investors. This approach focuses on global trends like climate change, gender equality, or clean water initiatives, allowing investors to back companies working on specific causes. Thematic investing is particularly attractive to younger investors, such as Millennials and Gen Z, who often prioritise social responsibility.

Using the SDG Framework for Ethical Investing

For investors who want to make a big difference on global challenges, the Sustainable Development Goals (SDG) Framework is a popular approach to guide your investments. The SDGs were created by the United Nations to tackle the world’s most pressing issues, and they can offer a roadmap for ethical investing.

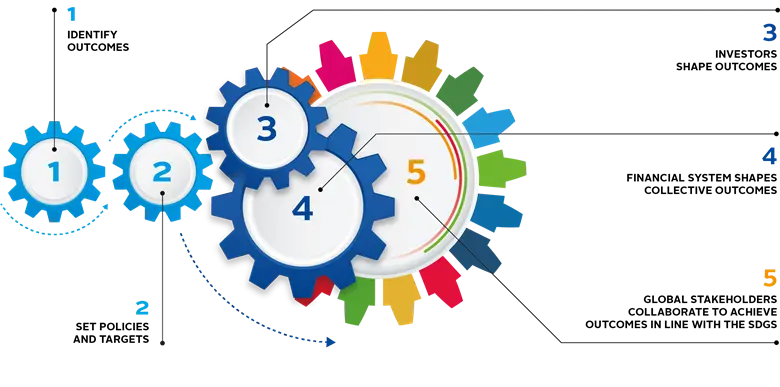

Here’s how it works in 5 simple steps:

- Identify Outcomes: Take stock of how your investments affect the real world—both positively and negatively. This helps you see how your money is supporting or possibly hurting progress toward the SDGs.

- Set Clear Goals: For example, if you care about clean water or renewable energy, your goals might focus on supporting companies in those areas. You’ll also want to look at how different issues—like climate change and water scarcity—are connected.

- Take Action: With goals in place, you can start making more informed investment choices. This might mean selecting certain companies, voting on shareholder proposals, or even engaging with policymakers to push for change.

- Financial System’s Role: Your investments are part of a bigger financial system. When investors work together, they can create a stronger push for SDG progress. Banks, insurers, and even credit agencies play a part in helping align investments with global goals.

- Global Collaboration: To truly reach the SDGs, all sectors—finance, businesses, governments, and communities—need to work together. By collaborating on tools and data, investors can better understand how to contribute to these goals.

The SDG framework gives ethical investors a structured way to make sure their money is working toward positive global change. It’s a more comprehensive way to align your investments with your values and make a measurable impact on the world.

Mitigating Greenwashing

To safeguard your portfolio from greenwashing, where a company promotes false or misleading information around its ESG practices, you can:

- Verify Company Claims

Look for third-party certifications or ESG ratings from reputable organisations. - Demand Transparency

Check if the company provides clear, measurable goals in their sustainability reports.

Is Ethical Investing Right for You?

Deciding whether ethical investing fits your financial strategy depends on your goals, risk tolerance, and investment horizon. If you’re willing to pay slightly higher fees and potentially sacrifice some short-term returns for long-term sustainability, ethical investing could be a great fit. Our team of financial advisors can help you evaluate your investment options and tailor a strategy that aligns with both your values and your financial objectives.

*General Advice Warning: The information provided in this communication is of a general nature only and does not take into account your personal objectives, financial situation, or needs. You should consider whether the information is appropriate to your individual circumstances before acting on it. We recommend that you seek independent financial advice tailored to your specific situation before making any financial decisions.