How Much Do I Need To Retire?

Working out how much you need to retire comfortably is one of the most important financial decisions you’ll make. This amount depends on several factors, including your expected retirement age, desired lifestyle, healthcare needs, and income sources such as pensions.

A common rule-of-thumb is to save 80% of your current annual income to maintain your lifestyle in retirement, however, this oversimplifies the complexities of retirement planning – after all, each person’s retirement is unique!

Factors such as income level, savings, and lifestyle needs can vary widely for each individual. As such, knowing how much you need to retire often calls for a more tailored approach so you can enjoy the retirement you want, while being financially secure.

Understanding Your Retirement Goals

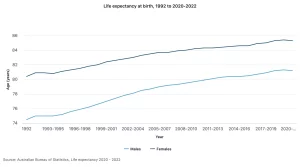

Start by considering your retirement age and how long you expect to be retired – retiring earlier means you’ll need more savings. As life expectancy in Australia has increased over the last 30 years, it’s essential to plan for a longer retirement period. The latest figures from the Australian Bureau of Statistics (ABS) show that average life expectancy for males is 81.2 years for males and 85.3 years for females, meaning your retirement could easily span two or even three decades.

This extended period requires not only more savings but also careful consideration of inflation, which can erode purchasing power over time.

Next, think about the lifestyle you want: Will you travel often, downsize your home, or pursue new hobbies? Do you plan to retire in Australia or overseas? These decisions can significantly impact your budget.

Additionally, factor in daily living costs like housing and groceries, and consider increasing healthcare needs as you age. Healthcare costs are an often underestimated part of retirement planning, and while Medicare covers many expenses, out-of-pocket costs for things like dental, vision, and elective procedures can add up quickly. As you age, it’s also likely that you’ll need more frequent medical care or even long-term care, both of which can be expensive, so it’s important to ensure you have the financial flexibility to account for any future medical or aged care needs.

Lastly, think about whether you plan to assist your family in the future, whether that’s contributing towards a new car, house deposit, wedding or school fees. Balancing your own needs with the desire to help loved ones requires careful financial planning. A well thought-out retirement plan will help ensure your retirement savings are sufficient to support both your lifestyle and any family assistance you wish to provide, without compromising your long-term financial security.

How Much Do You Need To Spend In Retirement?

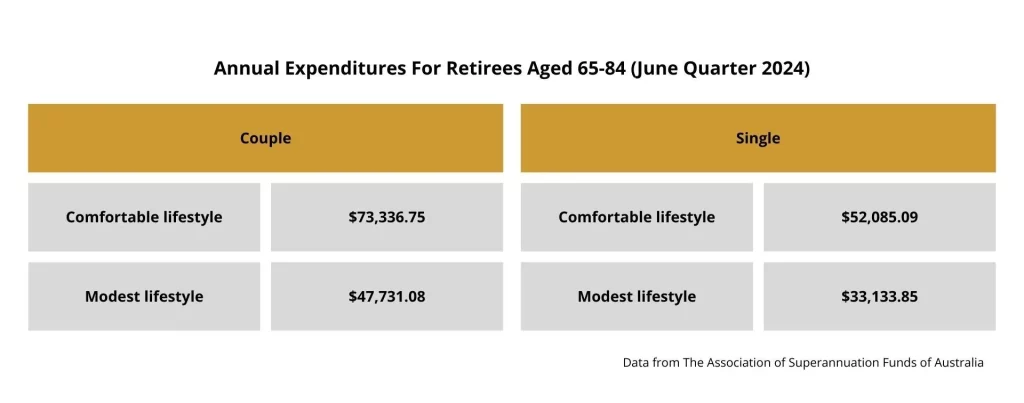

Based on the most recent data from June quarter 2024, a comfortable lifestyle would require retirees to spend nearly $52.1K as a single, or $73.3K as a couple.

These figures are just a benchmark and will vary based on factors such as housing costs, healthcare needs, and personal preferences. Your actual spending may be higher or lower depending on your unique lifestyle and retirement needs. For example, frequent travel, luxury items, and ongoing financial commitments could push these costs higher. That’s why it’s important to have a personalised retirement plan that aligns with your goals and circumstances.

How Much Super Do You Need For Retirement?

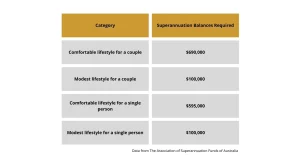

In Australia, superannuation is the cornerstone of retirement savings. The Association of Superannuation Funds of Australia (ASFA) has a Retirement Standard to estimate how much super you need to have saved to retire. The lump sums required are listed in the table above, and assumes that retirees will draw down all their capital, and receive a part Age Pension.

What If I Don’t Have Enough Savings To Retire?

If you find that your savings are falling short of your retirement goals, don’t panic! There are several strategies you can consider to improve your financial outlook.

- Consider Delaying Your Retirement By A Few Years

Working longer allows you to contribute more to your superannuation, increases your potential Age Pension entitlements, and reduces the number of years you’ll need to rely on your savings. - Reassess Your Spending

Ask yourself what you value most, and adjust your spending accordingly. Many people find that by making small adjustments, they can stretch their savings further without compromising their quality of life. - Adjust Your Investment Strategies

This might include increasing your superannuation contributions, reviewing your investment portfolio, or downsizing your home can help boost your financial resources.

Summary

Retirement planning is not a one-size-fits-all process. Your lifestyle, income sources, and financial goals are unique, and working with our expert team of financial advisors to create a tailored strategy for your retirement planning needs can help you build a financially secure and fulfilling retirement. We can help you maximise your income streams, manage risks like healthcare costs and market volatility, and support you to make informed decisions about complex issues like super withdrawals or investments. We also offer ongoing support, adjusting your plan as your needs change, so we can help you stay on track for a secure and fulfilling retirement.

*General Advice Warning: The information provided in this communication is of a general nature only and does not take into account your personal objectives, financial situation, or needs. You should consider whether the information is appropriate to your individual circumstances before acting on it. We recommend that you seek independent financial advice tailored to your specific situation before making any financial decisions.